40+ Personal debt to equity ratio calculator

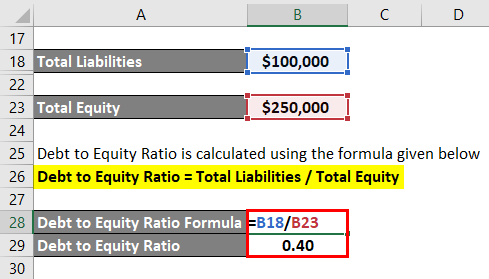

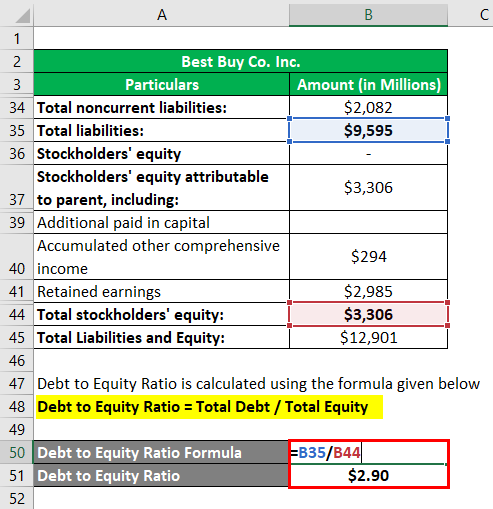

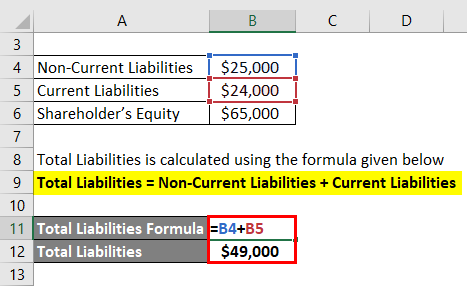

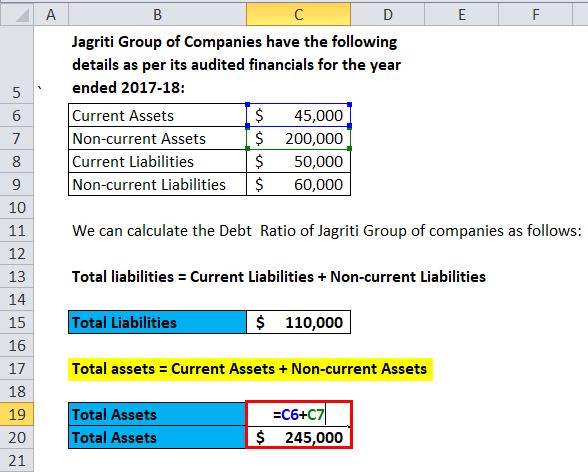

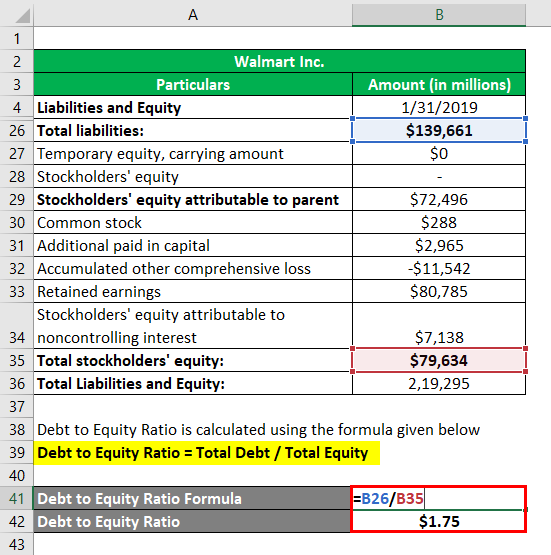

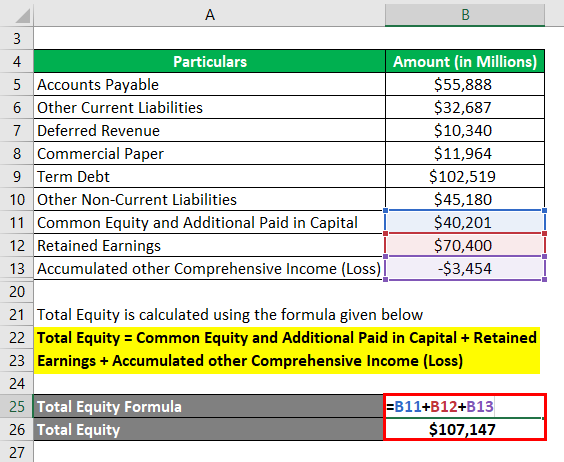

If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is 042. Debt to Equity Ratio Formula Example 3.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

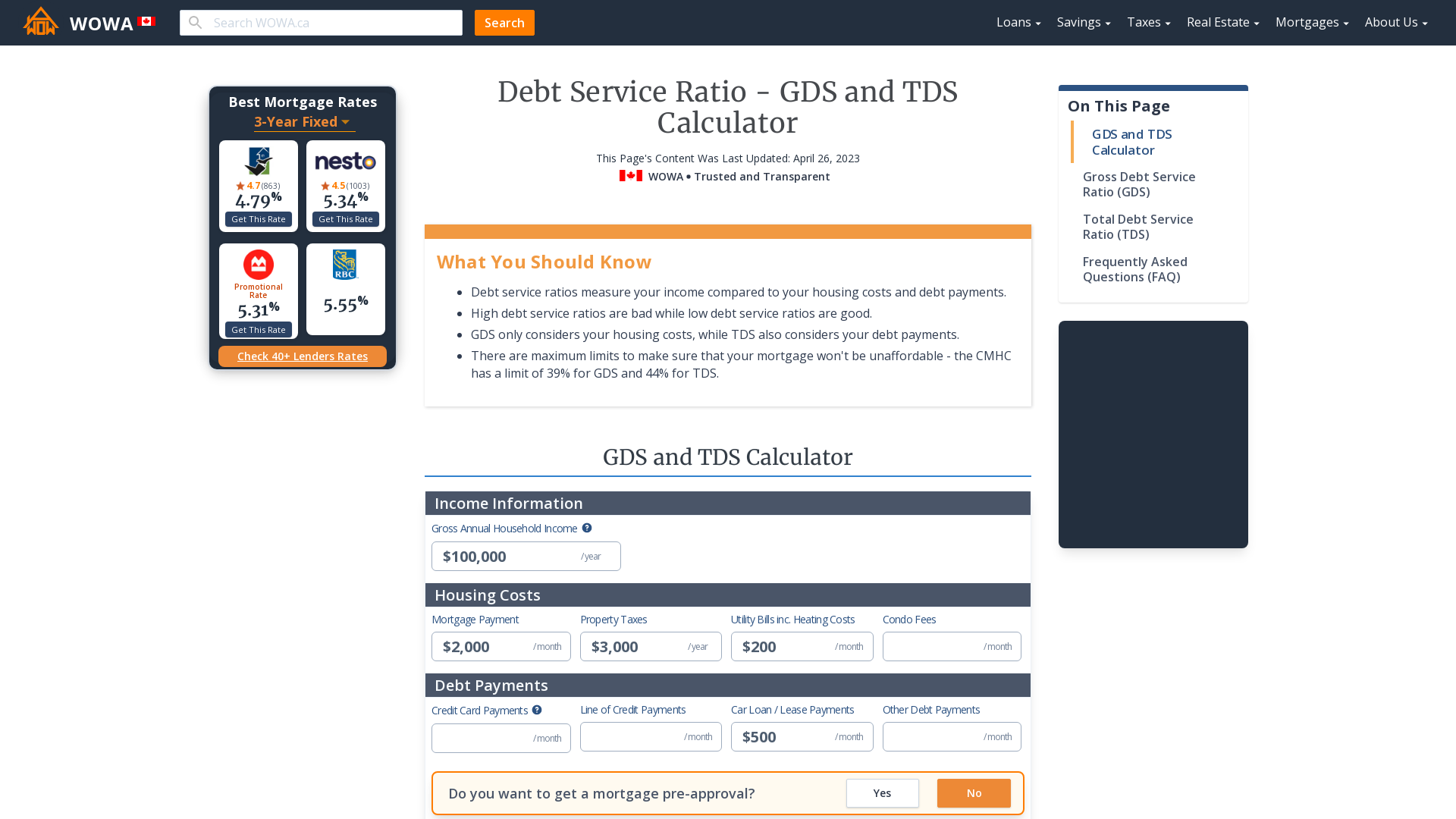

Use this calculator to quickly determine your debt-to-income ratio.

. Plus its a sign youre in financial trouble. Debt to Equity Ratio. Begin aligned text Debt-to-equity frac 241000000 134000000 180 end.

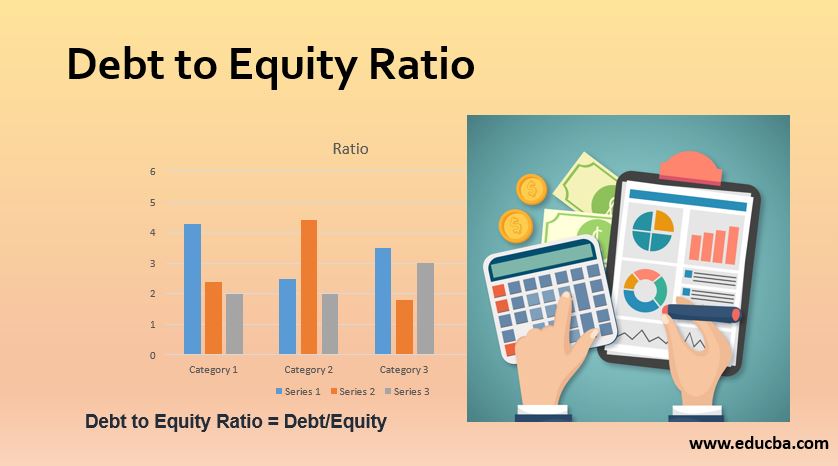

Debt to Equity Ratio Calculator. Debt Equity Ratio Total Debt Total Equity. This finance calculator will help you to calculate the debt-to-equity ratio DE from the total liabilities and the share holders fund.

Therefore this companys debt equity ratio is 25. 40 Personal debt to equity ratio calculator Senin 05 September 2022 Edit. Whats a good debt-to-income ratio.

Code to add this calci to your website. The lower your debt-to. Dont Wait For A Stimulus From Congress Refi Before Rates Rise.

Therefore the debt to equity ratio of XYZ Ltd stood at 040 as on December 31 2018. Simple Secure Online Application. For instance if your debt costs 2000 per month and your monthly income equals 6000 your DTI is 2000 6000 or 33 percent.

Let us take the example of Apple Inc. DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial leverage. Simply enter in the companys total debt and total equity and click on the calculate button to start.

This means that for every dollar in equity the firm has 42 cents in leverage. Use this calculator to quickly determine your debt-to-income ratio. Put Your Home Equity To Work Pay For Big Expenses.

The lower your debt-to-income ratio the more manageable your debt load will be. This equity ratio calculator estimates the proportion of ownersshareholders equity against the total assets of a company showing its long term solvency position. A DTI of 12 50 or more is generally considered too high as it means at least half of income is spent solely on debt.

A low debt-to-income ratio increases the odds that you will be able to meet your monthly obligations. We cannot and do not guarantee their applicability or. As a general rule debt to equity above 80 is considered very risky and financially unhealthy.

Ad Put Your Equity To Work. The lower your debt-to-income ratio the more manageable your debt load will be. Ad Compare Interest Rates And Repayments.

The equity ratio that results is 200000 500000 040 or 4000. Refinance Before Rates Go Up Again. This number doesnt necessarily portray a detailed picture of your financial strengths and weaknesses but it.

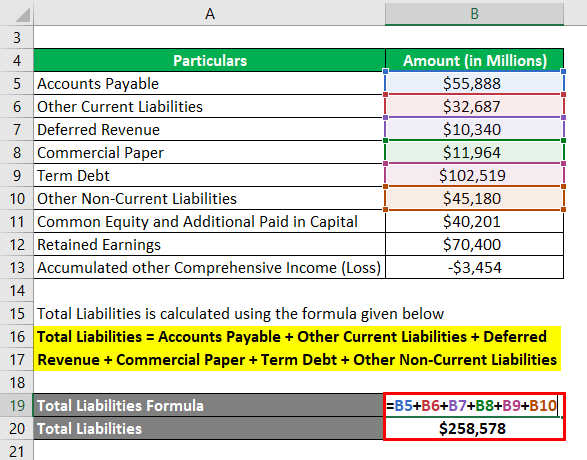

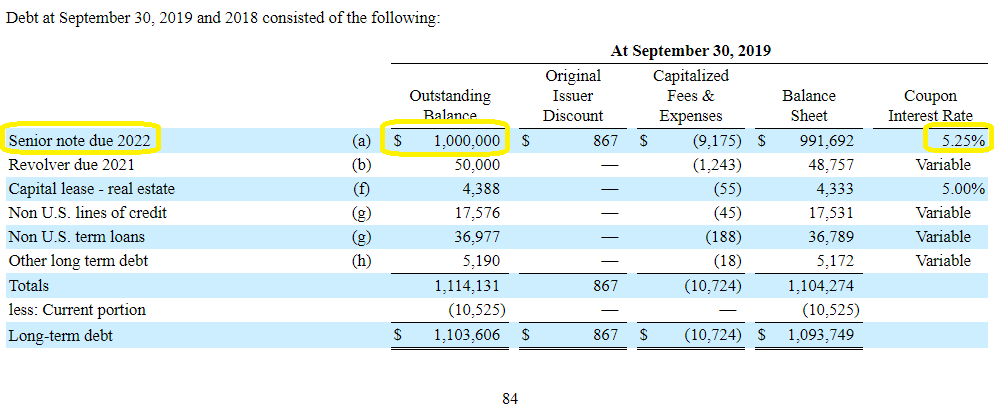

To calculate debt to equity ratio as per its balance sheet dated September 29 2018. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. The Debt to Equity Ratio Calculator calculates the debt to equity ratio of a company instantly.

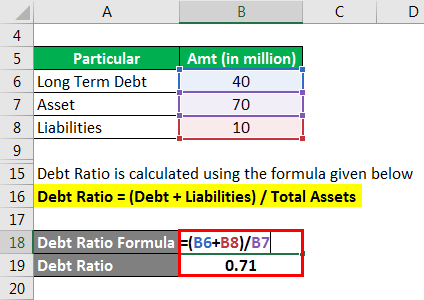

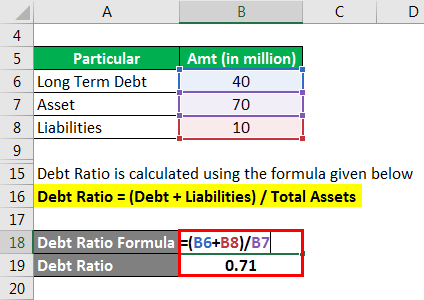

Sources and more resources. A debt to equity ratio is simply total debt divided by total assets or equity. Get Pre Approved In 24hrs.

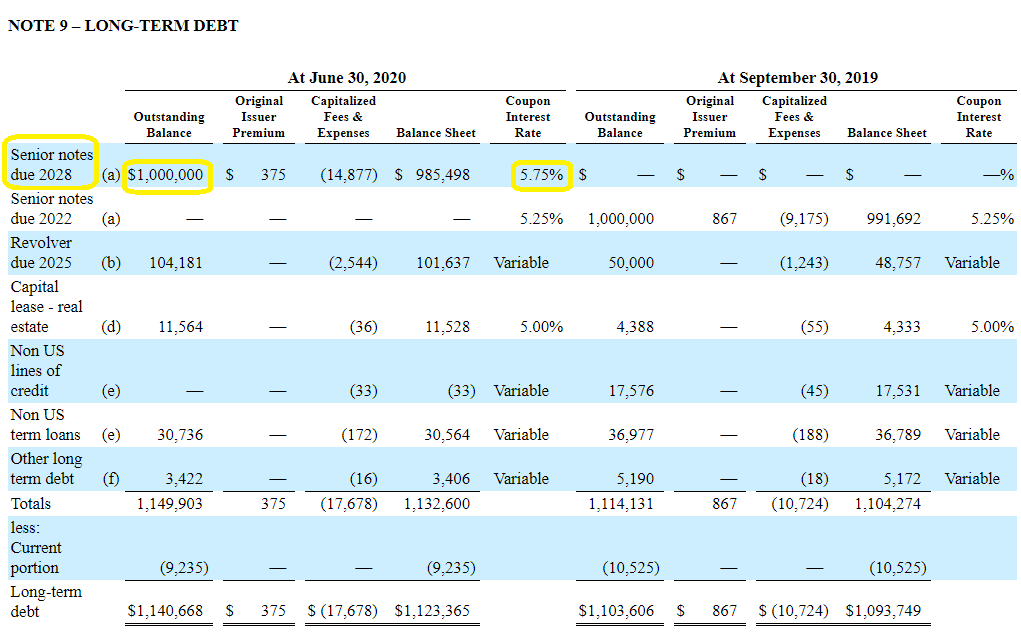

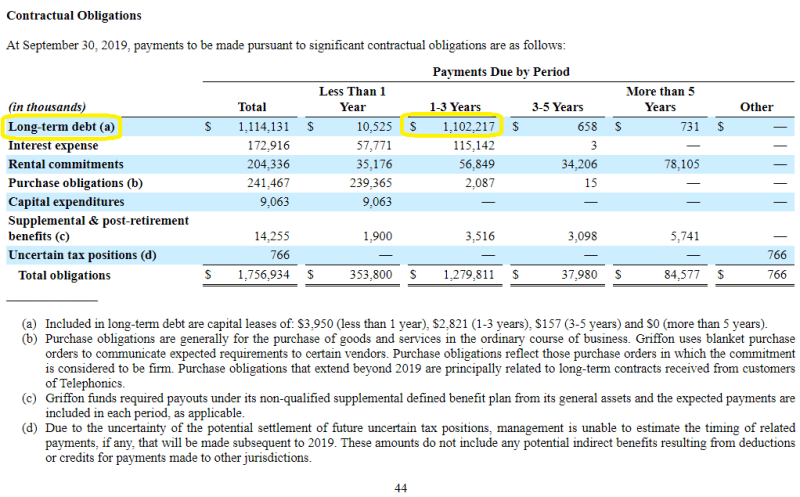

Its close cousin the debt-to-asset ratio uses total assets as the denominator but a DE ratio relies on total equity. DebtEquity Total LiabilitiesTotal. Harvard Business Review A refresher on Debt-to-Equity Ratio Explains what DE is how it is used and how it is calculated.

Debt to Equity Ratio in Practice. If a company has a debt to equity of. For example if your total assets equal 20000000 and the total of all your liabilities is 14000000 your debt to equity ratio would be 07 or 70.

Ad Apply For Home Equity Loan And Enjoy Low Rates. These figures are available on the balance sheet. The lower your debt-to-income ratio the more manageable your debt load will be.

Debt to Equity Ratio Calculator. A company has total debt of 5000 and total equity of 2000. To determine your DTI ratio simply take your total debt figure and divide it by your income.

Debt to Equity Ratio 040. A low debt-to-income ratio increases the odds that you will be able to. DER Total Liabilities Shareholders Equity 100.

A ratio higher than 40 could make creditors reject your application for an auto loan student loan or mortgage. Rates From 249 Fixed APR With Loans From 1000 to 100000. In the United States normally a DTI of 13 33 or less is considered to be manageable.

Use this calculator to determine your debt to income ratio an important measure in determining your ability to get a loan. A debt-to-income ratio under 30 is excellent and a ratio of 30 to 35 is acceptable. The debt to equity ratio is used to calculate how much leverage a company is using to finance the company.

This is an online debt to equity ratio calculatorThe debt-to-equity ratio DE is a financial ratio indicating the relative proportion of shareholders equity and debt used to finance a companys assets. While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health. This finance calculator will help you to calculate the debt-to-equity ratio DE from the total liabilities and the share holders fund.

This is the percentage of your gross income required to cover your housing and debt payments. Let us consider the total liabilities of the company is 15000 and. The difference between your credit score and your debt-to.

As a general rule debt to equity above 80 is considered very risky and financially unhealthy. In other words it is calculated by dividing a companys total liabilities by its shareholder equity. This is the percentage of your gross income required to cover your housing and debt payments.

A ratio of 1 would imply that creditors and investors are on equal footing in. 28 Apr 2015.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

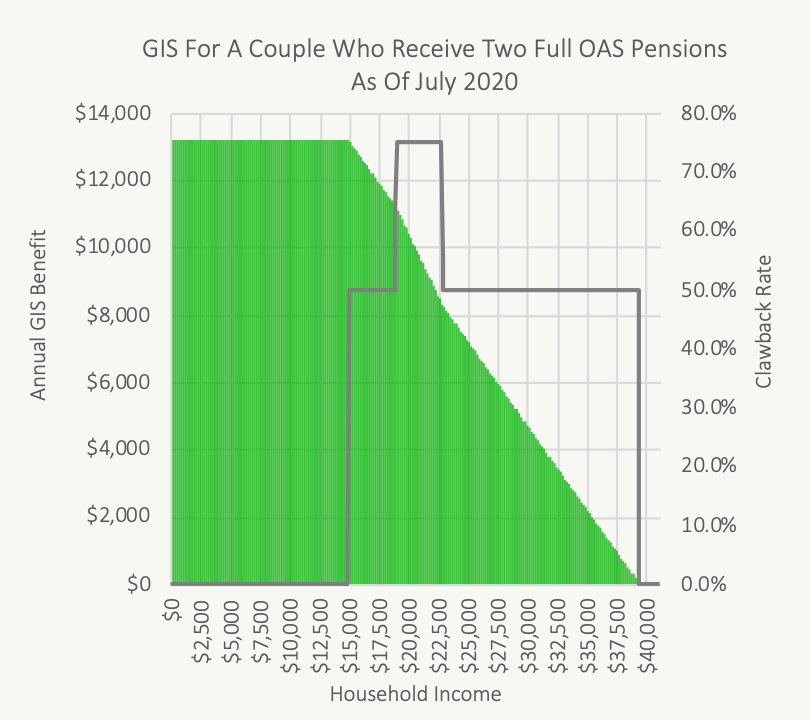

What Is The Guaranteed Income Supplement Planeasy

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

Debt Service Ratio Gds Tds Calculator Wowa Ca

Debt To Equity Ratio Benefits And Limitations Of Debt To Equity Ratio

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt Ratio Formula Calculator With Excel Template

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Body Composition In Sport Skinfolds Assessment Adam Virgile Sports Science

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt Ratio Example Explanation With Excel Template

Income Percentile Calculator For The United States

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Download An Income Statement Template For Microsoft Excel For August 2021 ᐅ The Poetry House Financial Statements Income Statement Statement Template Income